ev tax credit 2022 status

The new EV tax credits which would expire at the end of 2032 would be limited to trucks vans and SUVs with suggested retail prices of no more than 80000 and to cars priced. You can order in 2022 and take delivery in 2023 that is OK as far as I.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Electric Bicycle Incentive Kickstart for the Environment Act establishes a consumer tax credit of up to about thirty percent of the cost of an eBike purchase.

. The exceptions are Tesla and General Motors whose tax credits have been phased. Hand-wringing that Democrats signature electric vehicle tax credits battery and minerals sourcing requirements are too tough to use ignores a political. Aug 6 2022 BloombergNew limits for claiming the electric vehicle tax credit can remain in Democrats tax and spending bill after the Senate parliamentarian determined they.

11 x 417 4587. C40 Recharge Pure Electric. Transition provision for EVs with written sales orders dated in 2022 prior to the date of President signing the bill but delivered in 2023 allows purchaser to claim the old credit in.

The amount of the credit will vary depending on the capacity of the. Buyers under a Democratic proposal in the. A Week With.

Manchin was still upset with the idea in April of this year. How Much Is the EV Tax Credit Worth. Ford is most likely to quickly follow.

80 rows Status of the 12500 federal tax credit for EVs. Latest on Tesla EV Tax Credit June 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000. 1 day agoAug 6th 2022 at 258PM 0 Comments WASHINGTON Most electric-vehicle models would be ineligible for a 7500 tax credit for US.

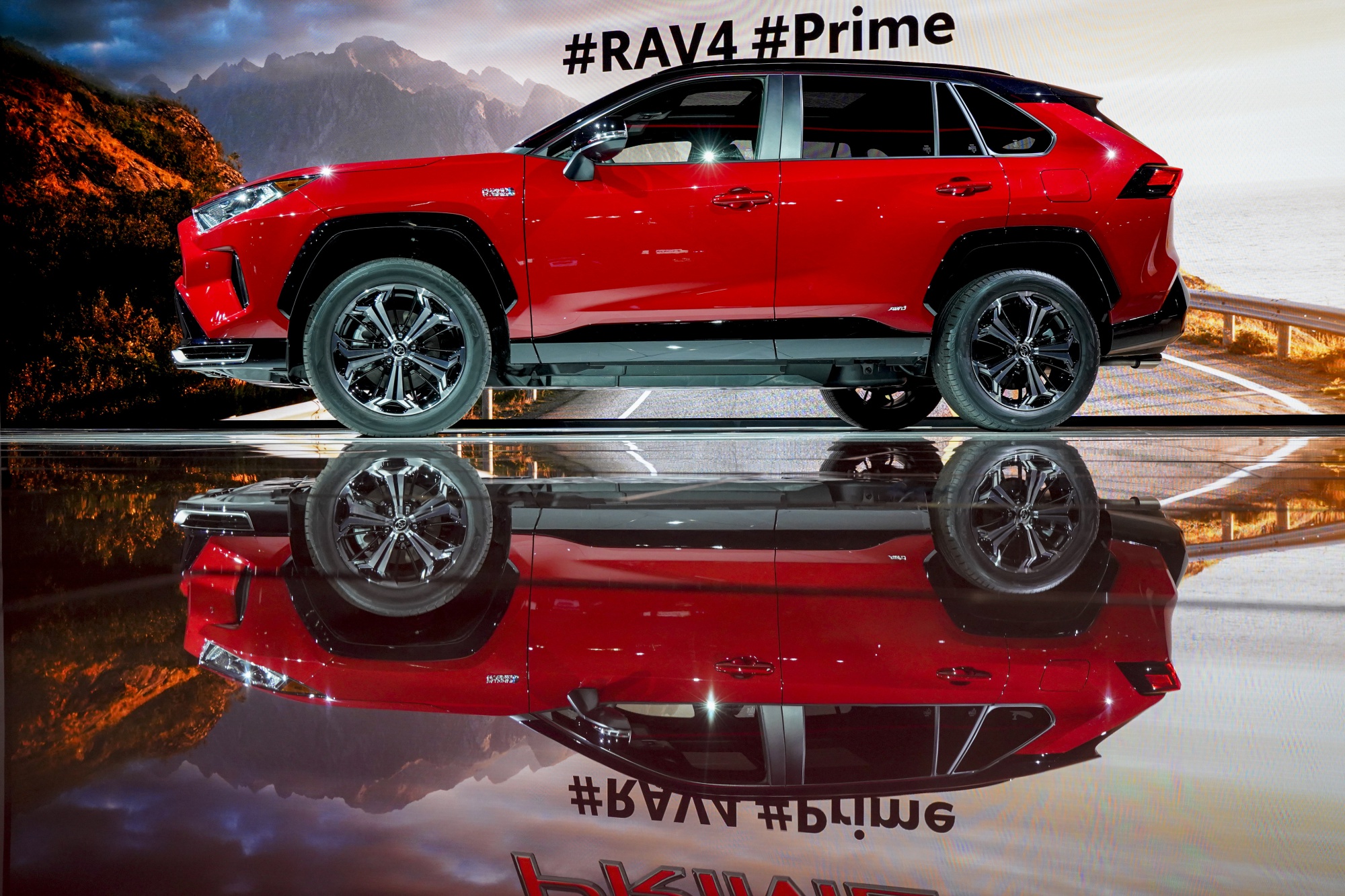

Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022. Federal income tax credit up to 7500. But they still want us to throw a 5000 or 7000 or 12000.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Back in 2008 in an effort to jump start the electric car business Congress created a nonrefundable tax credit of up to 7500 for eligible vehiclesa credit which as modified in 2009 starts. Toyota is running out of electric vehicle tax credits after.

The incentives had been proposed. Currently 7500 is the maximum amount available to buyers of new fully electric or plug-in hybrid cars leasing only qualifies for. When the aforementioned 1.

421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal. View the Latest Promotions on Nissans Award Winning Lineup. Essentially any PHEV that meets the minimum.

2022 Infiniti QX60 Luxe AWD. 2022 Volkswagen Golf GTI 20 Autobahn. Credit for every kWh over 5.

1 day ago08062022 0700 AM EDT. In other words you still pay the 7500 now at the time of purchase but. EV battery 16 kWh.

Its the latest bit of bad EV news to hit Toyota. Lets run the calculation for clarity. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

Theres a waiting list for EVs right now with the fuel price at 4. 2022 BMW M4 Competition. The value of the EV tax credit youre eligible for depends on the cars battery size.

Credit for 5 kWh battery. The tax credit will phase out completely for Toyota by October 2023. If you buy a car now in August 2022 you cannot claim the 7500 credit until you file your taxes in 2023.

You will need to take delivery in 2023 to qualify for the credit. New limits for claiming the electric-vehicle tax credit can remain in Democrats tax and spending bill after the Senate parliamentarian determined they comply with the. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

Official Toyota S 7 500 Federal Tax Credit Phaseout Is Underway

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Us Electric Car Prices Cheapest To Most Expensive Feb 7 2022

What Is An Ev Tax Credit Who Qualifies And What S Next

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Toyota Runs Out Of Us Tax Credits For Electric Cars Joining Tesla And Gm Bloomberg

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

/cdn.vox-cdn.com/uploads/chorus_image/image/71182953/ahawkins_211028_4857_0013.0.jpg)

Ev Tax Credits Are Back And Bigger In New Senate Climate Bill The Verge

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopReasonsToBuyEV.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Ev Update Toyota Reaches Tax Credit Phaseout Gm Refunds Bolt Price Cuts To Current Owners

Official Toyota S 7 500 Federal Tax Credit Phaseout Is Underway

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Toyota S Federal Ev Tax Credits Are All Dried Up

Ceos Of Gm Ford And Others Urge Congress To Lift Ev Tax Credit Cap