alabama delinquent property tax phone number

Offices of the Revenue Commissioner are located in the Administrative Building 462 North Oates St 5th Floor Dothan Al 36303. Tuscaloosa County Courthouse 714 Greensboro Avenue Room 124 Tuscaloosa AL 35401-1891.

Property Tax Analyst Resume Samples Qwikresume

Norris REVENUE COMMISSION CLARKE COUNTY ALABAMA CONTACT INFORMATION REVENUE.

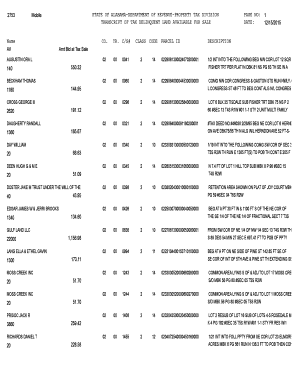

. 260 Cedar Bluff Rd Suite 102. Taxpayers will be able to pay online beginning October 1 2022. View Alabama tax delinquent properties available for purchase sorted by county including search by name or parcel number.

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. Payments on or after. If the property is not redeemed within the 3 three year redemption period Sec.

To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for. Taxes are due October 1. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax.

To report a criminal tax violation please call 251 344-4737. Calhoun County Revenue Commissioner. Cherokee County Revenue Commissioner.

Deadline to Pay Taxes. You may also pay by creditdebit card over the phone after October 10th each year by calling 205384. This gives you the ability to pay your.

Address or parcel number and pay taxes online. Taxes are delinquent on. Fastest-growing counties in Alabama.

Property taxes are due October 1 and are delinquent after December 31 of each year. Collecting all Real Estate Property taxes. As the Revenue Commissioner of Jackson County and on behalf of my staff we would like to welcome you to.

Number of parcels per map this number identifies which block on the. You may come to the Collection Department located at the Calhoun County Administration. C Pay property tax online.

October 1 - December 31 - Property Taxes Due October 1- November 30 - Registered Mobile Home Decals are renewed without penalty January 1 - Taxes Delinquent. 256 927-5527 FAX 256 927-5528. 1702 Noble Street Ste 104.

Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her. To report non-filers please email. Welcome to the Jackson County Revenue Commissioners Website.

PUBLIC NOTICE TAX LIEN PUBLICATION. The Tax Collectors Office is responsible for.

Blount County Revenue Commission Office Informational And Convenient Site For Blount County Taxpayers And Citizens

Property Tax Assessment Alabama Department Of Revenue

The Impact Of Accurate Data On Property Tax Management

Madison Co Tax Collector Sends Out Reminder For Property Taxes Includes New Policy For Non Payment

Opelika Observer Lee County 2020 Delinquent Tax List By Opelikaobserver Issuu

Property Tax Plan For Equalization Alabama Department Of Revenue

Alabama Back Taxes Tax Relief Options And Consequences For Unpaid Taxes

Fillable Online Revenue Alabama Transcript Of Tax Delinquent Land Available For Sale Revenue Alabama Fax Email Print Pdffiller

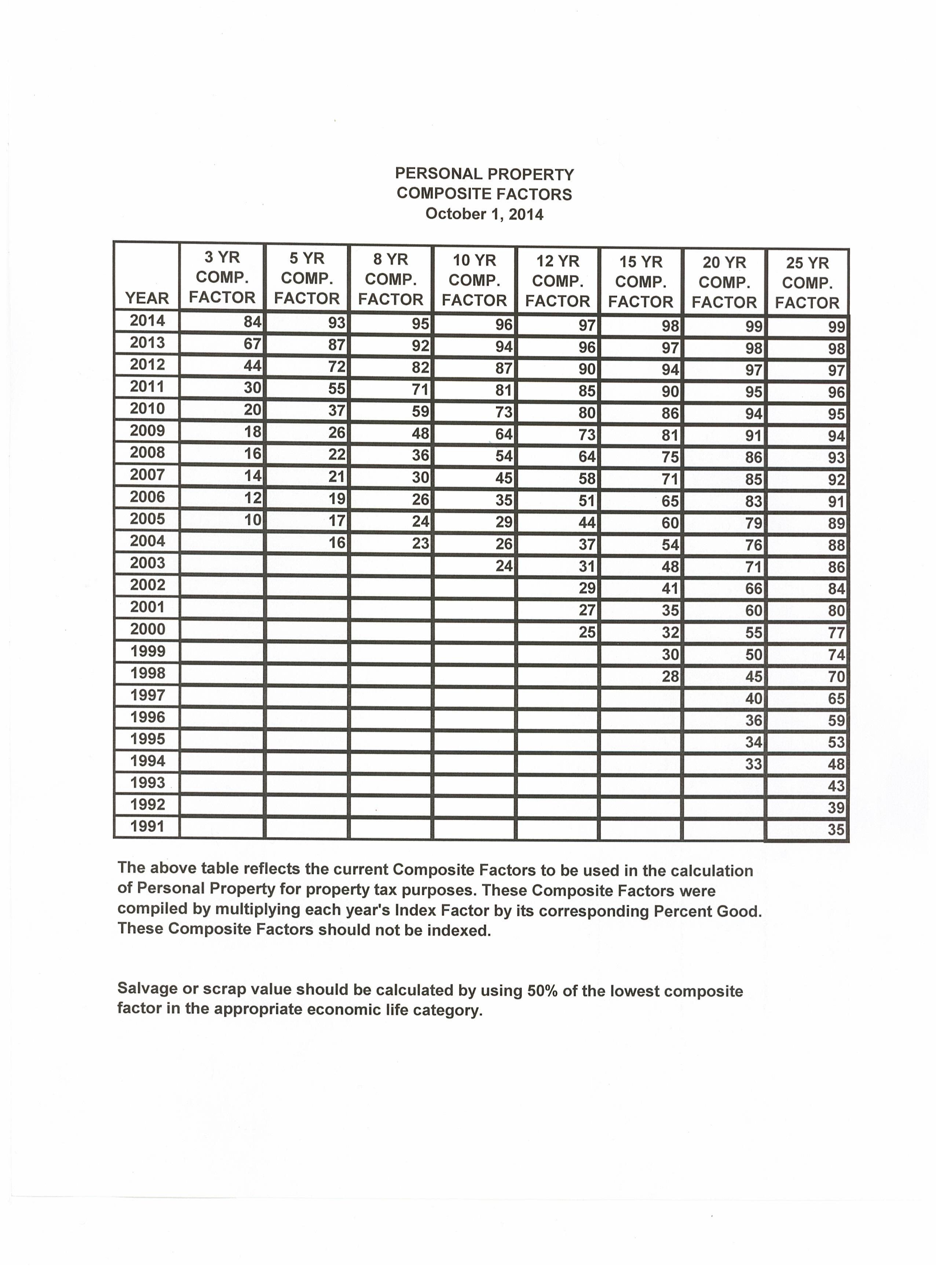

Jefferson County Personal Property

Tax Lien Sale Tuscaloosa County Alabama

2018 Lee County Delinquent Tax List 1st Run By Opelikaobserver Issuu

Tax Lien Properties Alabama Facebook

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Alabama Tax Delinquent Property Home Facebook

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site